Export of French cereals

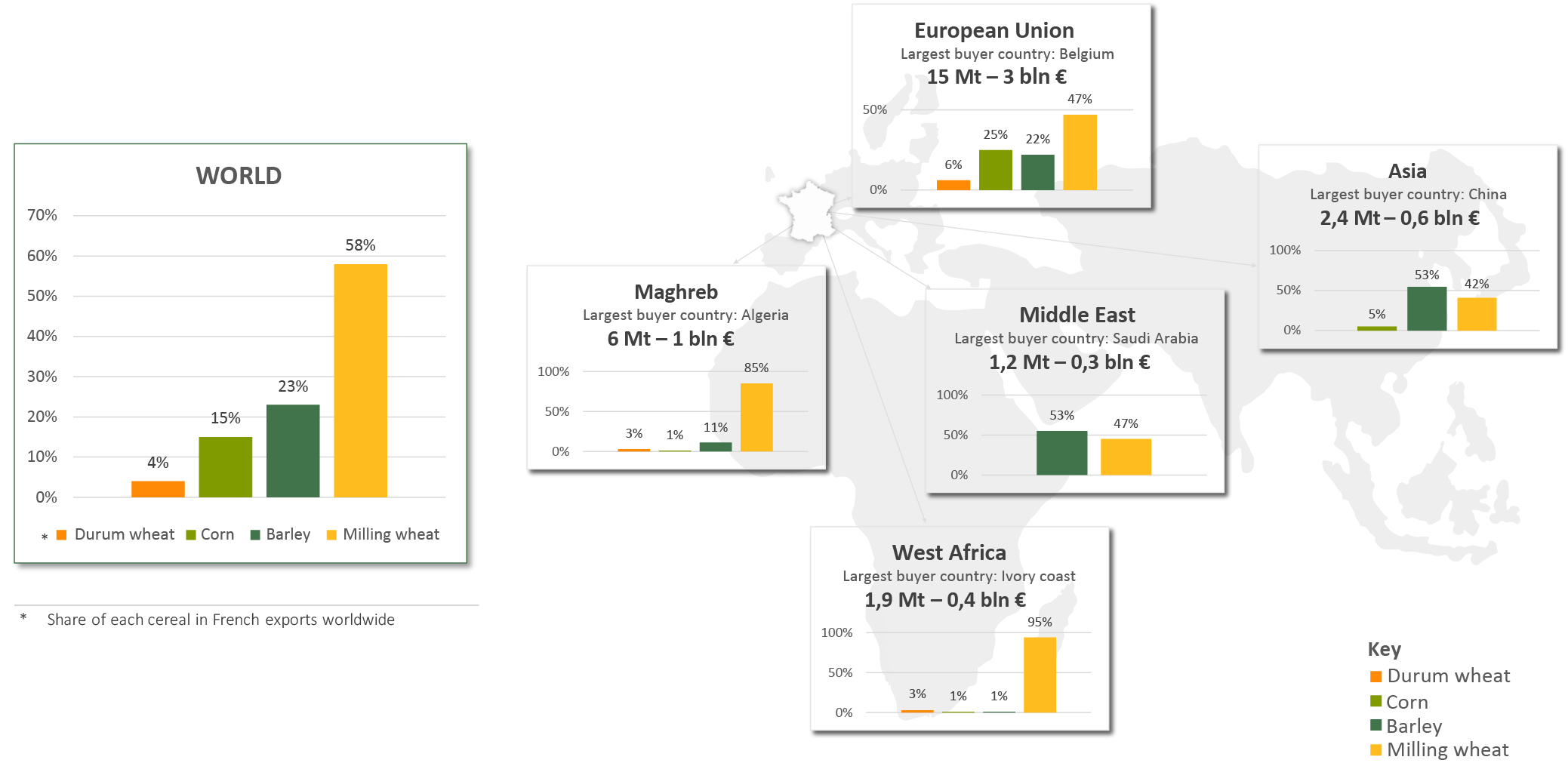

Which zones import French cereals ?

France’s cereal industry exports nearly one of every two tonnes of grain produced to its neighbours in the European Union, and to third countries (notably in North and West Africa, the Middle East, and China).

France – a major producer and exporter of cereals and cereal products.

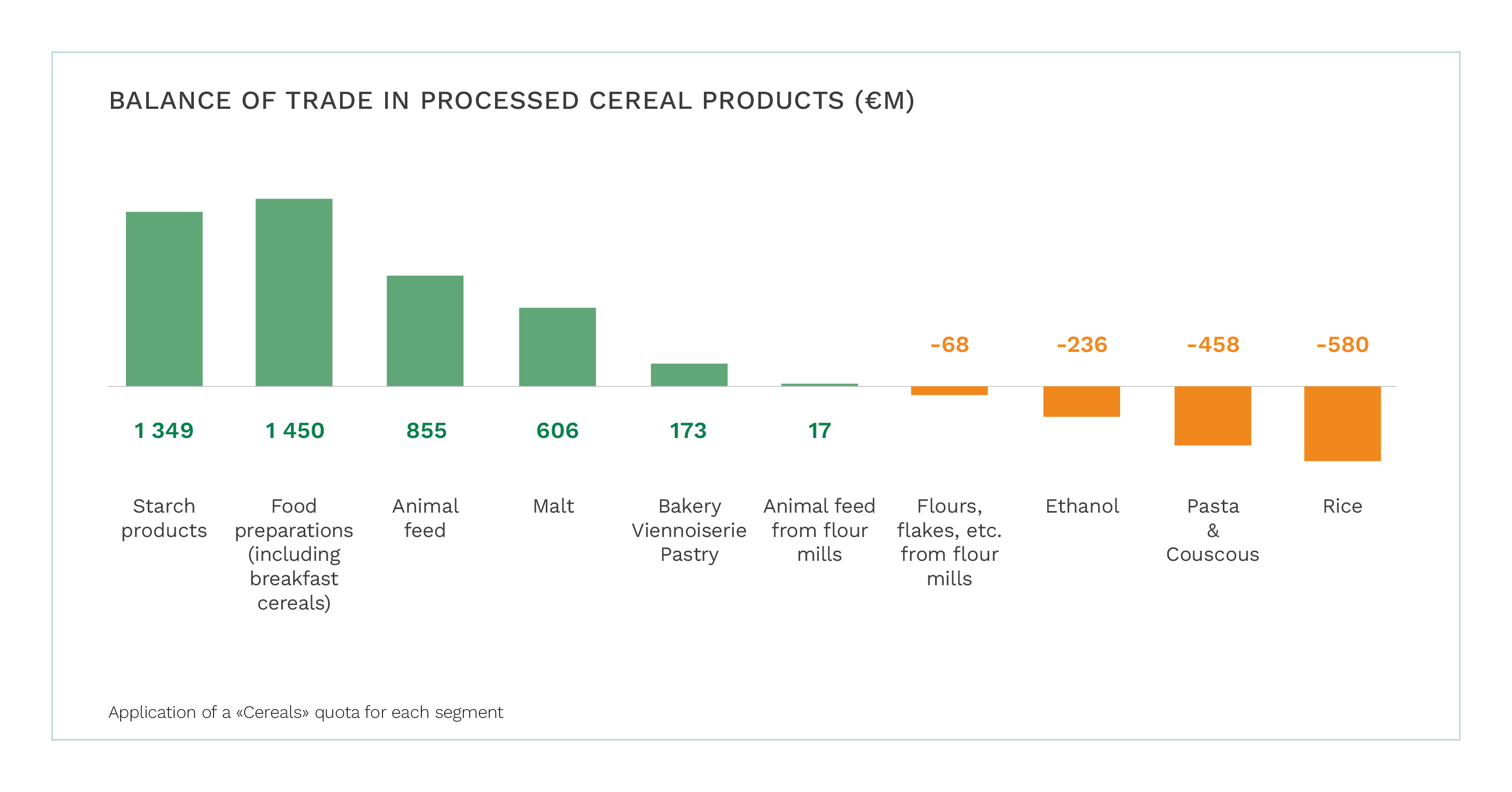

With a proven background of experience and efficiency, France’s grain industry also exports a substantial portion of the products its produces using cereals, such as malt, durum wheat semolina, corn semolina, starch and flour.

France is thus the world’s leading exporter of malt: 80% of its production is sold abroad. France also exports 75% of the starch it produces.

These volumes place cereals and cereal products as the second largest item in France’s agri-food trade surplus, behind wines and spirits (+7 billion euros – trade balance in 2021).

The excellence of French cereal production combined with France’s reliable logistics sector enable France to meet the multiple needs of buyers, processor and consumers across the various continents to which it regularly delivers. From varietal research to supply chain optimisation, whilst maintaining compliance with stringent sanitary requirements, France’s grain sector is constantly evolving. It is recognised as a key player in international grain trade.

Destinations of French cereal exports ?

29 Million tonnes worth 6 billion euros each year (5-year average: marketing years 17/18 to 21/22 - Breakdown of exports by volume (29 Mt) and value (€6 billion) for major regions - excluding South America and to non-EU zones - Switzerland & UK).

-

WEST AND NORTHWEST AFRICA

• Algeria and Morocco: largest non-EU export destinations for French wheat

• 20 Mt of wheat consumed each year in Maghreb countries (milling wheat + durum wheat). France is their principal milling wheat supplier

• Consumption amongst the highest in world (>180Kg/inhabitant/year)

• Imports needed to cover 60% of wheat requirement. These countries will remain as importers into the long term (demographic growth, environmental conditions)

• Local bread-making process is close to French model (baguette), which explains the natural suitability of French wheat

• French wheat also very present in Francophone West African countries, particularly Senegal, Côte d’Ivoire, Cameroon and Mali (consumption of baguettes)

• North and sub-Saharan African countries are also large importers of maize and barley, for use in animal feedMIDDLE EAST

• 400 million inhabitants from Egypt to Libya and Iran, via the Arabian Peninsula

• Birthplace of wheat, which constitutes major part of diet (notably in the form of flat breads)

• A structural and durable importing region, with the world’s largest wheat buyers

• Egypt: imports close to 12 Mt each year

• Zone of competition between all major global exporters: Black Sea countries, North Europe, USA, Australia

• French wheat exports vary substantially from year to year

• Region also includes the world’s largest importers of feed barley (Saudi Arabia, Iran, Jordan)CHINA

• World’s largest producer and consumer of wheat

• Self-sufficient in terms of wheat volumes produced: it imports different grades of wheat according to need

• World’s biggest producer and consumer of beer

• Large requirement for malting barley: China is France’s biggest export destinationEUROPEAN UNION

• Largest export for French cereals and cereal products such as malt, durum wheat semolina, corn semolina, starch, flour, etc.

• Almost all French corn exports, which are used for animal feeds and industrial purposes

• Between 40% and 50% of French wheat exports: wheat used for milling and animal feeds

• Extending the reach of France’s domestic market: standardised phytosanitary rules and same currency, within the framework of the European single market

• Major market for French barley, especially for malting barley -

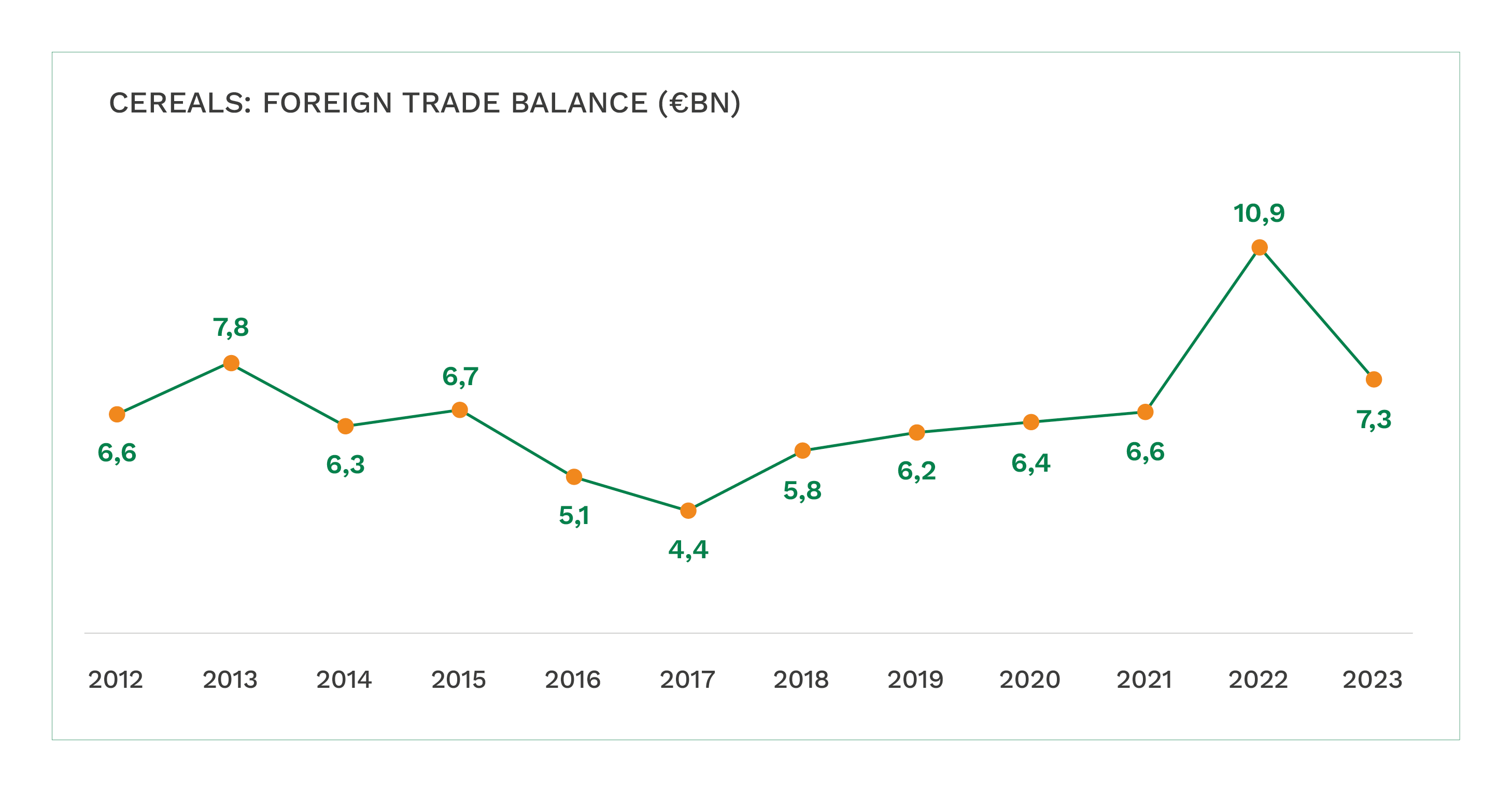

EXPORT CEREALS KEY FIGURES 2023 - TRADE SURPLUS = €10.4 billion (grains & processed products)

CEREAL PRODUCTS - A MAJOR CONTRIBUTOR TO THE SECTOR'S TRADE BALANCE : €3.1 BILLION

ⒸIntercéréales UNPROCESSED CEREALS - STRONG MOMENTUM IN FRENCH TRADE

ⒸIntercéréales -

To enhance the reach of French cereals abroad, Intercéréales has five permanent offices. These are in Paris, for the countries of the European Union (also our headquarters); in Casablanca, for Morocco, Tunisia, and sub-Saharan African countries; in Algiers for Algeria; in Cairo for Egypt, Libya, and the countries of Middle East; and in Beijing, for China. These locations also provide an understanding of changing customer expectations and global markets.

Implantation des bureaux Intercéréales à l'étranger | ⒸIntercéréales FRANCE

Anne-Laure PAUMIER: Director (Paris): apaumier@intercereales.com

Delphine DRIGNON: Relations with the French cereal sector and European markets (Paris): ddrignon@intercereales.com

CHINA

Charles Peng GAO : China - office in Beijing: itcpekin@163.com

MOROCCO

Yann LEBEAU: Morocco, Tunisia & West Africa - office in Casablanca: ylebeau@intercereales.com

ALGERIA & EGYPT

Roland GUIRAGOSSIAN: Algeria, Libya, Egypt & Middle East - offices in Algiers and Cairo : rguiragossian@intercereales.com

-

Institutional brochure IntercéréalesTéléchargement

PDF - 2.26 Mo